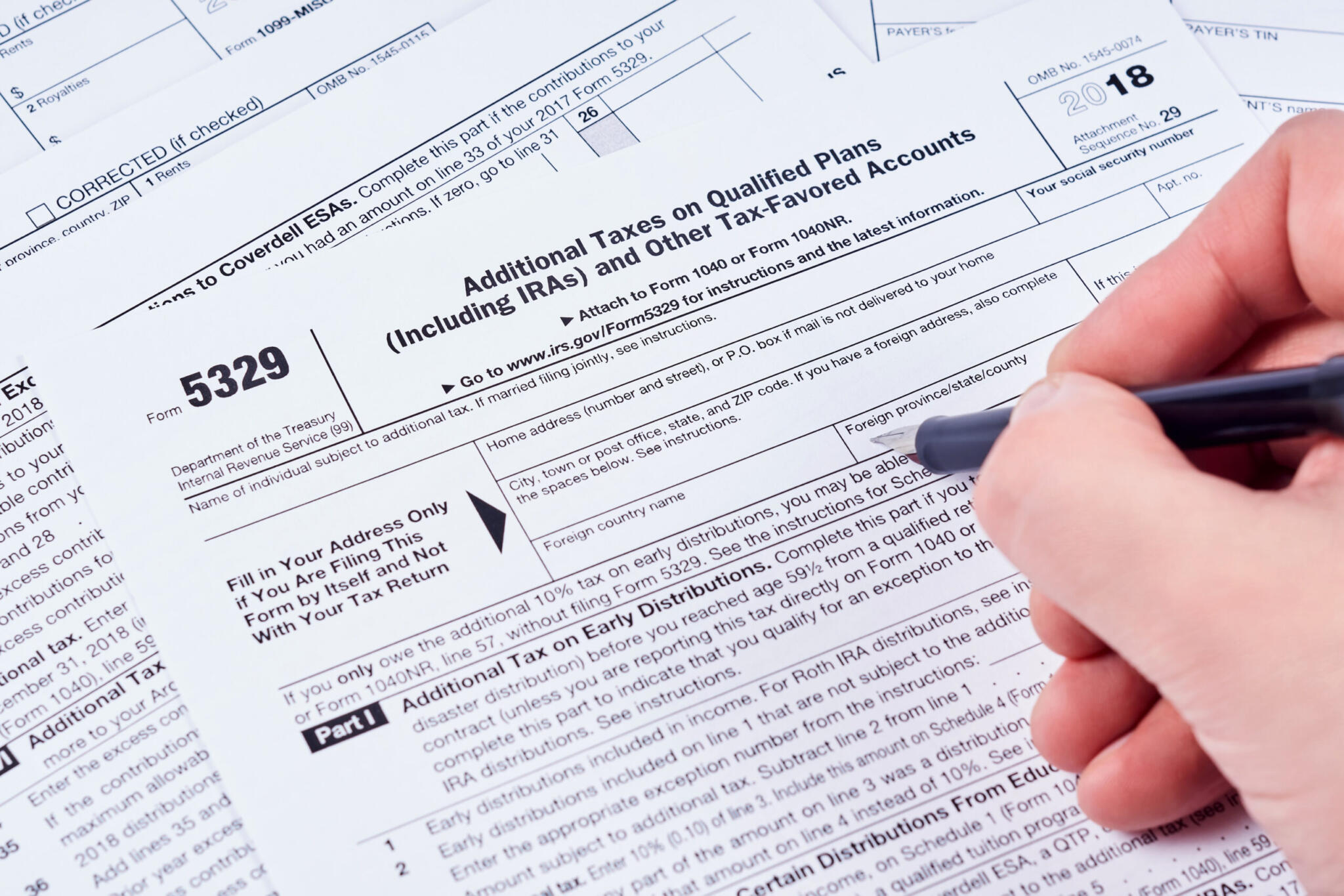

What Is Form 5329 - Web form 5329 is a tax form that allows you to report additional taxes on iras, other qualified retirement plans, modified. 10 — distributions due to an irs levy on the qualified. Web form 5329 is a tax form that reports additional taxes on qualified retirement plans, including individual. Web 09 — ira distributions made to purchase your first home, up to $10,000. Web what is form 5329?

10 — distributions due to an irs levy on the qualified. Web form 5329 is a tax form that reports additional taxes on qualified retirement plans, including individual. Web what is form 5329? Web form 5329 is a tax form that allows you to report additional taxes on iras, other qualified retirement plans, modified. Web 09 — ira distributions made to purchase your first home, up to $10,000.