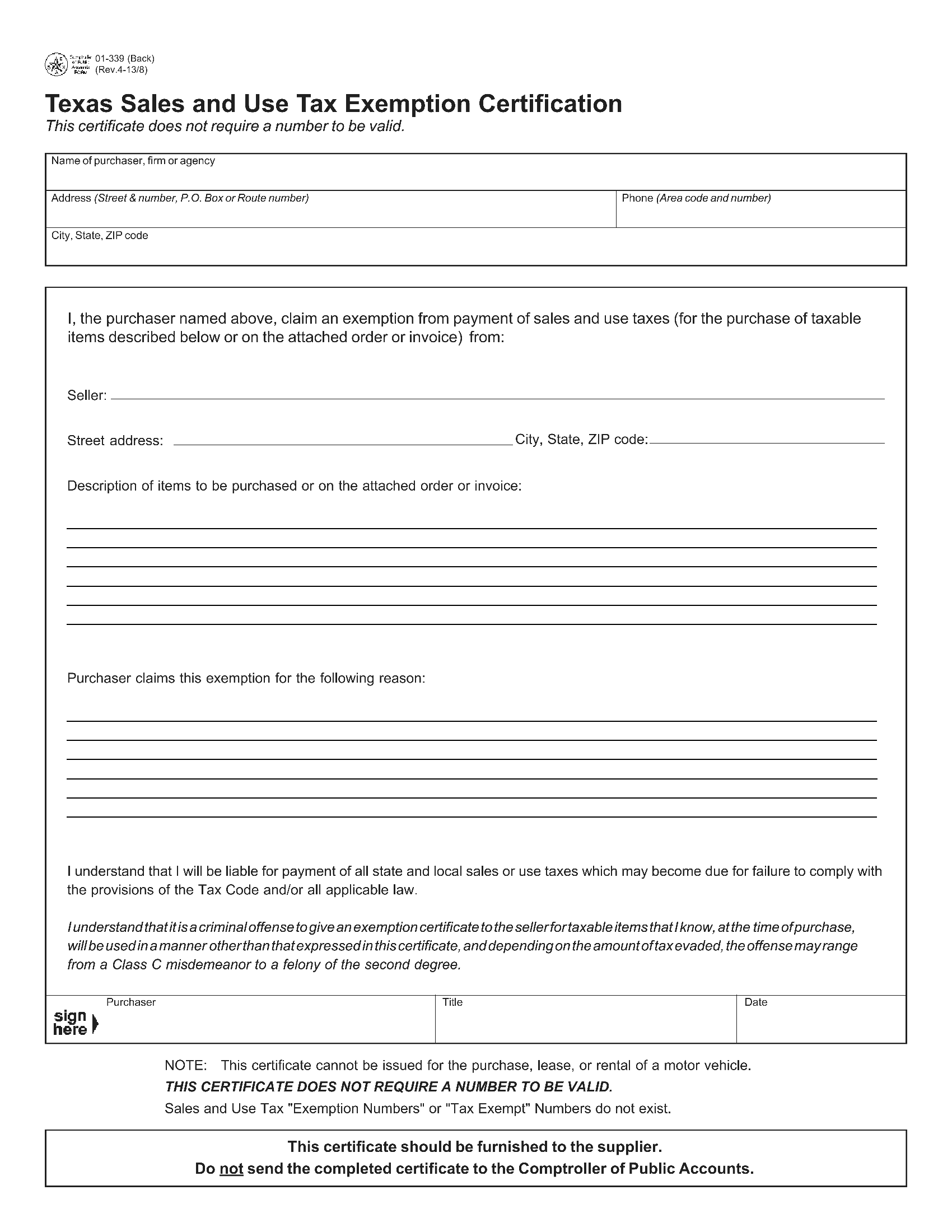

Texas State Sales Tax Exemption Form - Web close ⊠ texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as. Web there is no provision in tax code, chapter 151 (limited sales, excise, and use tax) for an exemption number or a tax exempt. Web texas sales and use tax exemption certification (tax exempt certificate) description: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web sales and use tax returns and instructions.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web close ⊠ texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as. Web sales and use tax returns and instructions. Web there is no provision in tax code, chapter 151 (limited sales, excise, and use tax) for an exemption number or a tax exempt. Web texas sales and use tax exemption certification (tax exempt certificate) description: