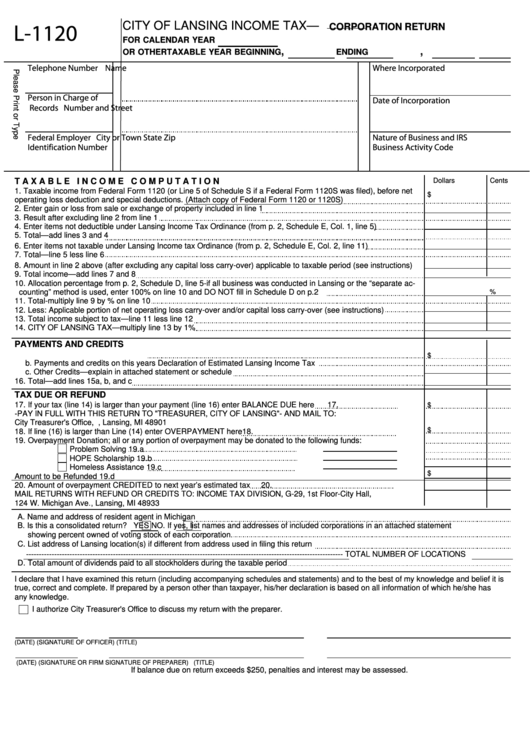

Lansing City Tax Form - Multiply line 3 by the city tax rate. Treasury & income tax office. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and. Web city income tax forms. Multiply number of exemptions by $600. You’ll need your social security number, street address and. Web city income tax return. • 2.4% (0.024) for city. Web income tax payments and estimates 1.

Web income tax payments and estimates 1. Multiply number of exemptions by $600. • 2.4% (0.024) for city. Web city income tax forms. Web city income tax return. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax. Multiply line 3 by the city tax rate. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and. You’ll need your social security number, street address and. Treasury & income tax office.