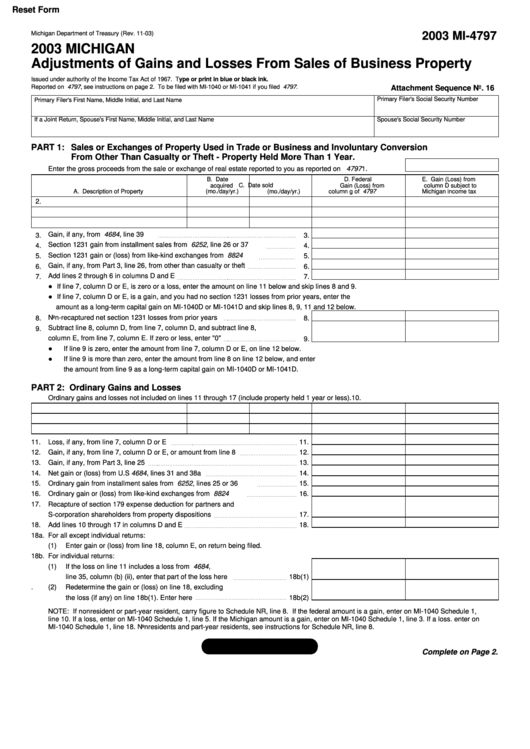

4797 Tax Form - Web form 4797 is used to report the sale or exchange of property used in a trade or business, for the production of. Web according to the irs, you should use your 4797 form to report all of the following: The sale or exchange of. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or.

Web according to the irs, you should use your 4797 form to report all of the following: Web form 4797 is used to report the sale or exchange of property used in a trade or business, for the production of. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or. The sale or exchange of.