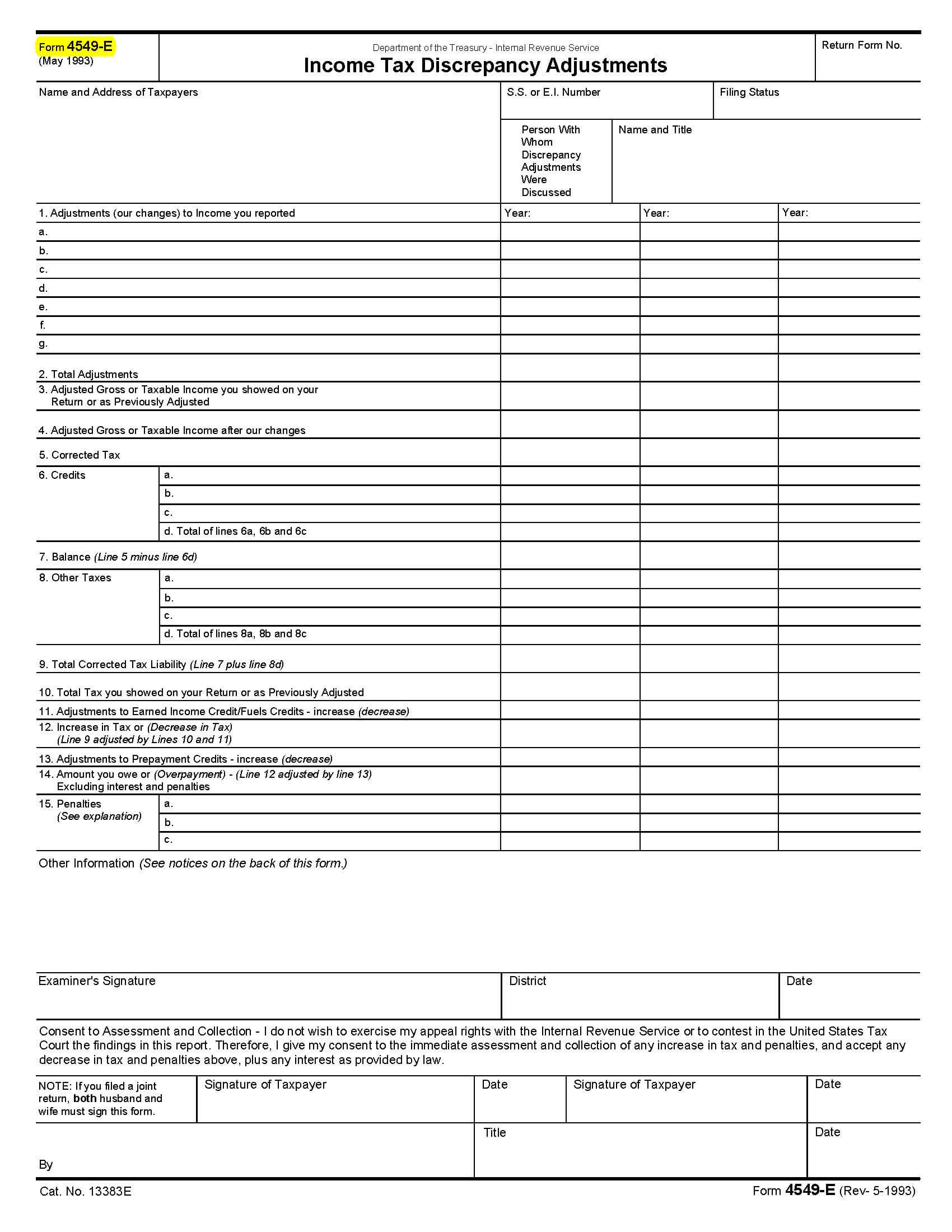

4549 Irs Form - Web a regular agreed report (form 4549) may contain up to three tax years. This form means the irs is questioning your tax return. Web the irs form 4549 is the income tax examination changes letter. If the irs is proposing income tax. The form will include a summary of the proposed changes to the tax return, penalties, and interest. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web the irs uses form 4549 when the audit is complete. But there are certain times when they are more likely to use this letter. Agreed rars require the taxpayer’s signature and include a statement that the report is. The agency may think you.

But there are certain times when they are more likely to use this letter. The agency may think you. Web a regular agreed report (form 4549) may contain up to three tax years. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web the irs uses form 4549 when the audit is complete. This form means the irs is questioning your tax return. Web the irs form 4549 is the income tax examination changes letter. Agreed rars require the taxpayer’s signature and include a statement that the report is. The form will include a summary of the proposed changes to the tax return, penalties, and interest. If the irs is proposing income tax.